Understanding and Managing Outstanding Debts in Your Tax Return

Understanding and managing outstanding debts in your tax return is crucial for maintaining financial health [...]

Navigating Basis Period Reform: Simplifying Taxes for Unincorporated Businesses

Navigating basis period reform represents a significant shift in tax regulations for unincorporated businesses, promising [...]

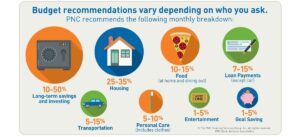

Smart Strategies for Self-Assessment Tax Bill Budgeting

When it comes to managing your finances, smart strategies for self-assessment tax bill budgeting can [...]

How to file your dormant accounts – Companies House

All corporations registered at Companies House are legally obligated to submit their accounts, irrespective of [...]

Companies House digital graduate scheme

Seizing an opportunity to broaden my skill set and gain a host of different experiences [...]

Identifying Significant Control in Your UK Company Owned by an Overseas Entity

Is your business controlled or owned by a foreign legal entity, such as a company [...]

Understanding PAYE Underpayments on Your Self-Assessment Tax Return

Understanding PAYE underpayments on your self-assessment tax return is crucial for individuals who receive income [...]

Determining Your UK Entity’s People with Significant Control: A Comprehensive Guide

Navigating the intricacies of determining People with Significant Control (PSCs) within your UK entity is [...]

How do I end or leave a business partnership?

Ending or leaving a business partnership is a significant decision that requires careful consideration and [...]

Maximizing Self-Assessment Tax Return: A comprehensive guide to navigating and optimizing your online tax return

Maximizing your self-assessment tax return is not just about meeting your obligations but about leveraging [...]